intermediate simulations in excel

creating simulations from scratch for better decision models

DATE: Wednesday, February 5, 2020

TIME: 9:00aM – 12:00PM CDT (UTC-5)

PRICE: $375

the webinar

learn how to use one of the most important quantitative methods most models don’t use

What’s the chance that a project will lose money or be cancelled? What’s the most likely return on investment for a given investment? How likely is a particular risk or set of risks to happen – and how severe could their impacts be?

Running simulations has been shown to measurably improve estimates in uncertain decisions, but how can you run a simulation without complicated software requiring advanced training?

Building on the Basic Simulations in Excel course, we will continue the discussion with some intermediate topics that will improve the performance and versatility of your decision models. Using only features of native Excel, you’ll learn how to:

Use more advanced probability distributions, such as the lognormal, beta, and power law distributions

Compute information value when you have a model with several variables

Adjust your cash flows based on a stated risk tolerance

Incorporate more advanced features of Excel that even regular Excel users don’t utilize like they could or should

Participants will also gain access to Excel templates that expand upon the templates from the previous course with additional features.

After attending Intermediate Simulations in Excel, you’ll have the ability to improve upon an Excel simulation to help you answer the critical questions every successful decision requires.

register for the webinar

the method

why you need simulations in your decision models

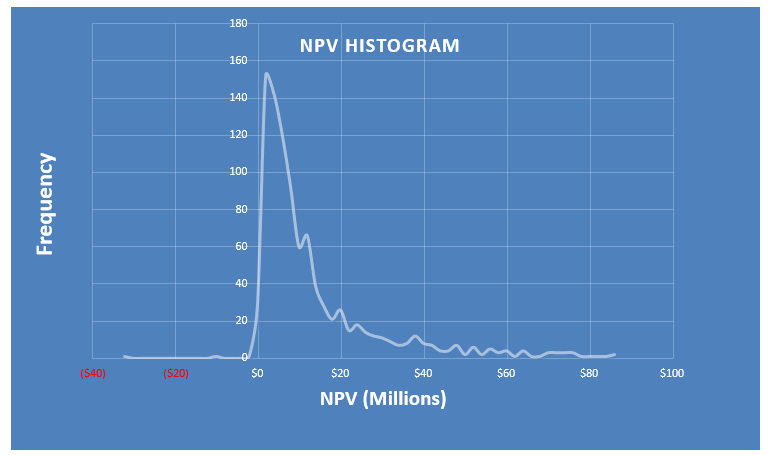

What keeps every decision from being a great one is the fact that for every decision, there exists a range of uncertain future results, some of which will be a quantified loss. To calculate risk, we need a way to calculate thousands of the possible scenarios and outcomes that could happen to find out which are most likely.

Enter the Monte Carlo simulation. Born out of the Manhattan Project, the Monte Carlo simulation uses randomly-calculated values to run thousands of scenarios and calculate the most likely outcomes. Studies have shown how the use of a Monte Carlo simulation tool can measurably improve forecasts in everything from NASA unmanned space probe mission risk to the financial performance of oil exploration firms.

Simply put, the the Monte Carlo simulation is one of the best quantitative analysis tools we have available – and adopting it to make better decisions is one of the best decisions one can make.

the presenter

about doug hubbard

Mr. Hubbard is the inventor of the powerful Applied Information Economics (AIE) method. His management consulting career started 30 years ago with Coopers & Lybrand, focusing on the application of quantitative methods. The last 20 years he has completed over 100 projects for the application of AIE to solve current business issues in many areas including IT benefits and risks including cybersecurity, engineering risks, market forecasts for pharma and medical devices, environmental policy, mergers & acquisitions, Silicon Valley startups, the likelihood of success of new movies, and military logistics to name a few. His AIE methodology has received critical praise from Gartner, Forrester, and others.

He is the author of the following books (all published with Wiley, between 2007 and 2016):

- How to Measure Anything: Finding the Value of Intangibles in Business (one of the all-time, best-selling books in business math)

- The Failure of Risk Management: Why It’s Broken and How to Fix It

- Pulse: The New Science of Harnessing Internet Buzz to Track Threats and Opportunities

- How to Measure Anything in Cybersecurity Risk (co-authored with Richard Seiersen)

His books have sold over 140,000 copies in eight languages and are used as textbooks in dozens of university courses including the graduate level. Three of his books are required reading for the Society of Actuaries exam prep, and he is the only author with more than one on the list. In addition to his books, Mr. Hubbard is published in the prestigious science journal Nature as well as publications as varied as The American Statistician, CIO Magazine, Information Week, DBMS Magazine, Architecture Boston, OR/MS Today and Analytics Magazine.

About us

Hubbard Decision Research (HDR) is a consulting firm that applies quantitative analysis methods to the most difficult measurements and challenging decisions across many industries and professions. Using Applied Information Economics, HDR has developed quantitative analysis solutions to information technology investments, military logistics, entertainment media, major policy decisions, and business operations, for clients ranging from small businesses to Fortune 500 companies. More information can be found at hubbardresearch.com.